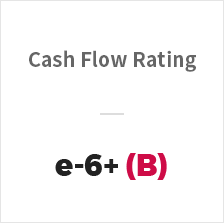

Finance / Credit Rating

Finance / Credit Rating

Finance / Credit Rating

Finance / Credit Rating

Major Financial Ratio

| Financial Items | 2017/12 | 2018/12 | 2019/12 | |

|---|---|---|---|---|

|

Growth Potential |

Total Asset Growth Rate | 61.0 | -0.8 | 37.8 |

| Sales Growth Rate | 158.0 | 32.8 | 96.9 | |

| Profitability | Total Return on Capital | 6.2 | -62.6 | -60.4 |

| Total Return on Capital | 11.2 | -39.0 | -21.1 | |

| Interest Compensation Ratio | 480.7 | -2,343.6 | -2,515.5 | |

| Reserve Ratio | 43.9 | Impaired Capital | -133.4 | |

| Stability | Current Ratio | 109.6 | 54.8 | 112.5 |

| Borrowing Dependence | 35.5 | 63.6 | 20.5 | |

| Equity Capital Ratio | 43.1 | Impaired Capital | 26.0 | |

| Debt Ratio | 131.8 | Impaired Capital | 284.3 | |

| Activity | Total Asset Turnover | 1.2 | 1.5 | 2.1 |

| Trade Receivable Turnover | 3.2 | 2.5 | 4.1 | |

Financial Status by Year

UNIT : million KRW

| Settlement Date | Total Assets | Capital | Equity Capital | Sales | Operating Profit | Net Income |

|---|---|---|---|---|---|---|

| 2019/12 | 6,723 | 3,632 | 1,749 | 12,044 | -2,547 | -3,504 |

| 2018/12 | 4,879 | 1,191 | -825 | 6,115 | -2,384 | -3,068 |

| 2017/12 | 4,920 | 1,191 | 2,122 | 4,605 | 516 | 248 |

| Special Note | ||||||

Definition of Corporate Evaluation and Rating

| Credit Status | Corporate Evaluation Rating | Definition of Corporate Evaluation Rating |

|---|---|---|

| Outstanding | AAA | A level with the highest level of commercial performance. |

| AA | Having the ability to carry out good business transactions, the ability to cope with environmental changes is sufficient. | |

| A | With good commercial transaction performance, the ability to cope with environmental changes is considerable. | |

| Fair | BBB | Good commercial transaction performance is recognized, but the ability to cope with environmental changes is somewhat limited. |

| Normal | BB | Although short-term commercial transaction performance is recognized, the ability to cope with environmental changes is limited. |

| B | The ability to carry out short-term commercial transactions is recognized, but the ability to cope with environmental changes is insufficient. | |

| Bad | CCC | The level at which credit risk is implied at this point |

| CC | At this point, the likelihood of credit risk occurring is high. | |

| C | At this point, there is a high probability of credit risk and a very low possibility of recovery in the future. | |

| Bankrupt | D | The level of inability to trade and equivalent thereto. |

| Out of the Ranking | R | Rating Absent: Hold judgment due to non-compliance with credit rating, non-compliance with data, closure of business, etc. |